If you are a commercial landlord, agent, or a close follower of current affairs in the property market, you have probably seen recent news headlines concerning the performance of secondary office stock.

According to Savills’ UK Regional Office Investment Market Watch Q2 Report, overall market shrinkage has accelerated post-COVID, with a net loss of 67 million sq ft in the last decade, while demand has increased for alternative use. Notably the gap between prime and secondary office stock demand is widening, but refurbishment and development activity continues to flat-line.

Image by Freepik

What is secondary office stock?

Also known as Grade B or Class B buildings, this office grade typically describes buildings constructed 10 to 20 years ago that are considered “average” standard as compared to state-of-the-art Grade A facilities and less desirable Grade C stock. Traditionally, this grade has performed well, offering Occupiers a good balance between functionality and affordability

The impact on tenant uptake

There has been a strong rebound in return-to-office since the pandemic which should be driving demand for office uptake. At the beginning of the year, RICS suggested that UK commuting hit 70% of pre-COVID levels and has remained at that level over the course of the year.

However, the latest leasing statistics and anecdotal evidence is clearly painting a different story. One example is of a commercial agency in the South East, who reported a single commercial space enquiry in August – a record low for the company.

So, what is driving this?

Is it just becoming too expensive to rent office space?

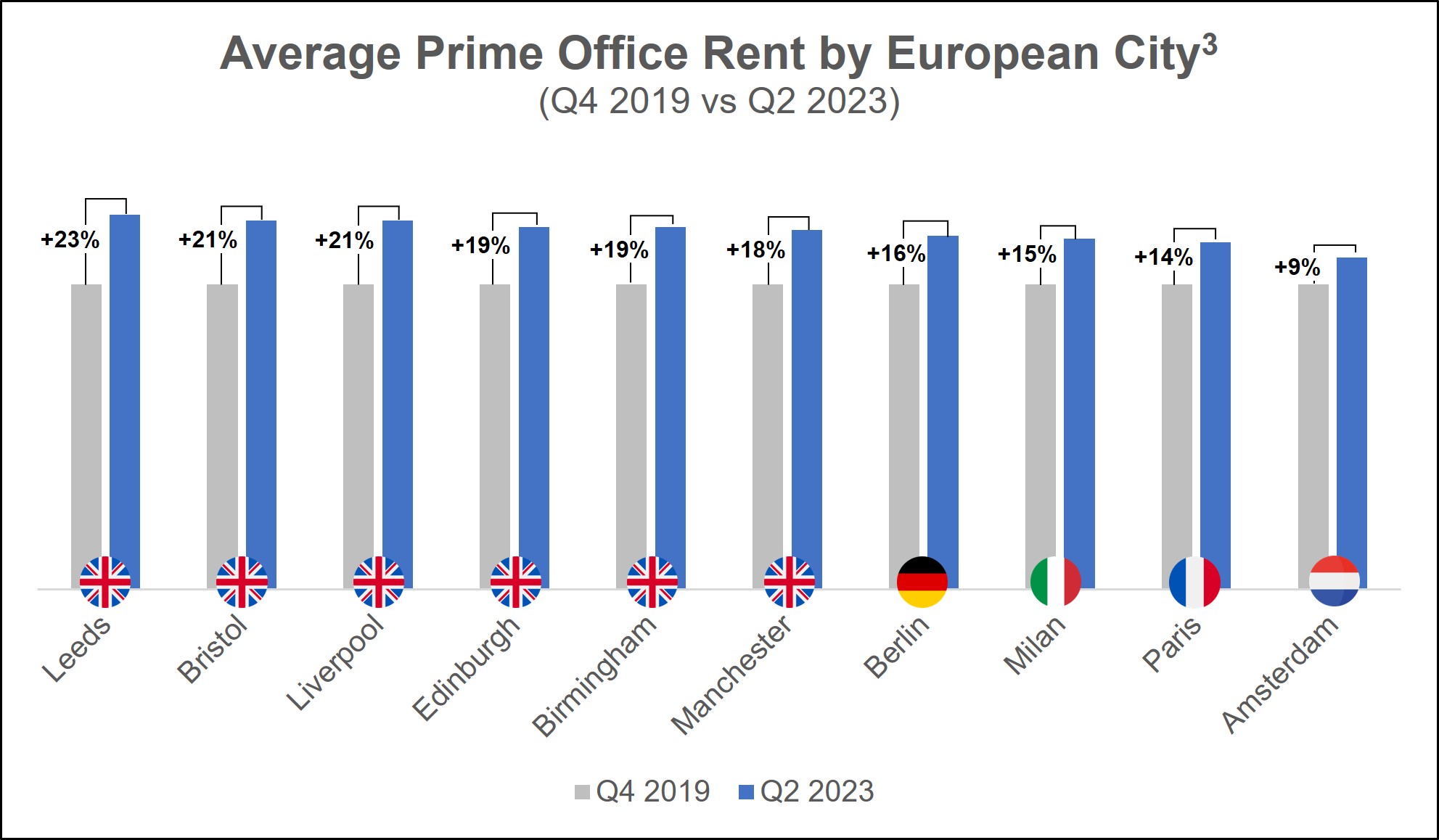

According to CBRE research, since the start of the pandemic (Q4 2019 to Q2 2023) prime rental growth has increased significantly in all major UK cities that they evaluated compared to their European counterparts. This is, at least in part, been driven by the large increase in mortgage interest rates.

Are Grade B and C buildings still good substitutes?

With the aid of new property management technologies, landlords and tenants are becoming more aware of the cost and impact of energy usage. Increasingly organizations are looking to align their property strategy with broader ESG objectives, opting for buildings with better sustainability certifications.

On top of heightened demand for BREEAM projects and the relative rise in rental premiums for buildings with best-in-class credentials, the UK Government is also seeking to enforce changes to minimum energy requirements in the next few years. Currently, the Minimum Energy Efficiency Standards (MEES) prevents new leases being granted for commercial properties with an EPC rating below E. Under the new changes, the Government will demand a minimum EPC rating of C by 2027 and B from 2030.

While many landlords may not want to refurbish or redevelop their existing secondary stock, they may have to if they want a chance of leasing them in the near future.

On top of this, mechanical and electrical services are designed to last about 15 years. Given that the majority of Grade B stock is around 10-20 years old, replacement of services can cost several £ millions depending on the size of the building. While this has always been the case, work-from-home requirements during the pandemic forced a lot of companies to invoke lease breaks. In effect, landlords potentially missed out on 2-3 years of rent, reducing their safety net for future capital investments

Increasing desirability of secondary office stock?

If you are an investor or landlord with a stake in secondary office stock, you are probably already feeling the effects of market shrinkage on your portfolio. You are likely experiencing less occupier interest, slower buying processes, and more demands and requirements from tenants than in previous years, e.g. longer rent-free periods.

According to the latest research, spaces that are “ready to occupy” are becoming increasingly desirable for prospective tenants. This is known as delivering to Cat A+ grade or “plug and play”, including all the necessary fittings and furnishings for occupancy without any personal touches, e.g. branded finishings. Savills suggest that this is particularly the case for smaller units, typically below 6,000 sqft, which account for a large proportion of Cat A+ deals.

Colloquially, the process is being termed “rentalizing” where a landlord proactively readies a space for immediate tenancy. With a Cat A+ space, landlords can typically expect to increase rental premiums by 5-10% and halve the rent-free incentive. But as with any investment, the decision to fit-out depends on the period in which you expect to amortize the costs over.

While there may initially appear to be an incentive for landlords to keep the cost of the fit-out to a minimum, they must also consider trade-offs between the specification (quality of finishes/furnishing) of the fit-out, the premium they can charge and rent-free incentive they can reduce as a result. The latter factors will also depend on other variables such as location, building amenities, size of office, building density etc.

A rough indication of fit-out costs are presented below for reference:

| High Specification | Mid Specification | Low Specification | |

|---|---|---|---|

| Price per sqft (£) | 100+ | 60 | 40 or below |

*Indicative only

Want a free comprehensive breakdown of costs for your project? Contact us at hello@magentaprojects.co.uk

What if you do not want to invest in a fit-out?

We generally recommend marketing an indicative design before commencing a build. What we mean by this is working with expert architects and interior designers to develop a space plan and some 3D renders of the fitted space to help tenants to visualize how they could potentially use your space. 3D rendering has come a long way in the last decade and can really help tenants that struggle to follow floorplans or other technical drawings. been a strong rebound in return-to-office since the pandemic which should be driving demand for office uptake. At the beginning of the year, RICS suggested that UK commuting hit 70% of pre-COVID levels and has remained at that level over the course of the year2.

Image by vecstock

This tends to be a good strategy if you have the funds to sustain a campaign over time or if you are leasing similar units in the same building.

However, if you are looking to shift a space faster or a unit in a more obscure location, depending on the size and complexity of your project, a fit-out could be a better option. For instance, take a 5,000 sqft space, using a design and build contractor you could expect to complete a fit-out in 6 weeks, allowing 1-2 weeks additional time for design and procurement.

Want a free indicative design for your next project? Drop us a message at hello@magentaprojects.co.uk or use the form below

How much of your portfolio should you consider upgrading?

Not all Occupiers expect or want their new space to be fitted out. Some Occupiers already have a bespoke design in mind or have incredibly niche requirements that a typical floor plate will not accommodate for. Therefore, it is always worth consulting with local commercial property agents to gage market conditions, tenant requirements and appetite before starting any fit-out project.

-

What if you own commercial property that is not currently used as an office? In this case, a fit-out may be necessary to remove existing amenities and facilities that can be sold or repurposed elsewhere. A simple Cat A or Cat A+ fitout may also be necessary to help prospective occupiers to better visualize the space repurposed as an office.

-

What if you own a block of near identical or very similar units? Again, this can almost always be a perfect opportunity for a fit-out. Why? Say you decide to fit-out one of five units you own, this not only reduces the letting void for the unit that is fitted out, i.e. it typically rents out faster. It also provides tenants with more flexibility to choose a fitted or non-fitted option increasing the likelihood they will sign with you.

What else can you do with your secondary office stock?

You should also consider options to convert your space for alternative uses. As with any construction project, conversion of office space for alternative use is subject to planning restrictions and can be a lengthier process than a traditional fit-out.

However, in lots of cases, you can see much quicker buying processes and higher returns with conversions.

Options you may want to consider include:

- Serviced / co-working office space

- Dry or wet lab space

- Student accommodation

- Hotel or serviced apartments

- Residential

Savills’ latest market report also reinforced the resilience of the life sciences sector in today’s climate. Take-up by life sciences in The Golden Triangle (Oxford, Cambridge and London) is set to be the highest ever recorded by the end of the year. Demand is particularly focused on lab and research facilities, with take-up set to be the highest ever recorded in Oxford and Cambridge by the end of the year. For landlords, the potential to charge higher rental premiums for the same space makes it an attractive market to cater for.

Learn more about past projects we have deliveredCover image by ArthurHidden